Blog

Four ways to boost CX with seamless transactions

Event

Genesys APAC Partner Conference, Bangkok, Thailand

Event

Genesys Xperience, Denver, CO

Event

Enterprise Connect, Orlando, FL

Blog

Three steps to taking the complexity out of contact center payments

News

PCI Pal® is Awarded Payments Compliance Technology of the Year at Payments Awards 2023

News

PCI Pal Teams up with Zoom to Create Exceptional Secure Payment Experiences

News

PCI Pal Named 2023 Compliance Software Solution of the Year

Blog

Secure Payment Solution Providers: Key to Call Center Security

Blog

AI-Powered Speech Recognition Payments: A Strategy for Contact Centers

News

PCI Pal Augments Automatic Speech Recognition (ASR) Solution

News

Golden Nugget partners with PCI Pal® to Improve Payment Experience with Conversational AI

Video

Golden Nugget Case Study

Success Story

Enhancing contact center payment security and compliance for Secret Escapes

News

PCI Pal® supports Secret Escapes in enhancing Payment Card Security and Compliance

News

PCI Pal Extends Partnership with PCI Security Standards Council to Help Secure Payment Data Worldwide

News

PCI Pal receives triple shortlisting at the 2023 Payments Awards

Blog

Driving a Successful Customer Journey: The Contact Center Agent Experience

Success Story

Crafting Trust: Arts & Crafts Superstore Protects Customer Payments

News

PCI Pal Achieves AWS Service Ready Designation for Amazon Connect

Blog

Could enhancing your contact centre customer experience be the key to unlocking customer loyalty?

Blog

PCI DSS Compliance Checklist

Blog

Conversational AI: Payment Fraud Prevention and Data Protection

News

PCI Pal is Enhancing Contact Center Payments Through the Power of Conversational AI

Podcast

Securing Contact Centers: Beyond Pause and Resume Recording

Blog

Protecting Online Card Payments: Explore PSD2 and 3D Secure

News

PCI Security Standards Council welcomes PCI Pal® CISO, Geoff Forsyth, to its Board of Advisors

Blog

Exploring ACH and Open Banking: US vs. Europe

News

PCI Pal Named Finalist in 2023 Security Awards

White Paper

Pause and Resume Call Recording: Calculating the Risk

News

PCI Pal® listed in Growth Index Top 100 ranking of UK’s fastest growing companies for the second consecutive year

News

NFP Health Deploys PCI Pal to Streamline Contact Center Payments

Success Story

NFP Health Secures Remote Contact Center Payments with PCI Pal

Blog

Securing ACH Payments in Contact Centers

News

PCI Pal Featured on CardRates.com

Blog

Why Pause and Resume Call Recording Isn’t Enough

Blog

4 Steps to Secure Contact Center Payments

Blog

A Guide to Digital Payment Link Security

Success Story

Darlington Borough Council

News

Darlington Borough Council Secures Contact Center Payments with PCI Pal®

Podcast

Payments Trends and Predictions for 2023

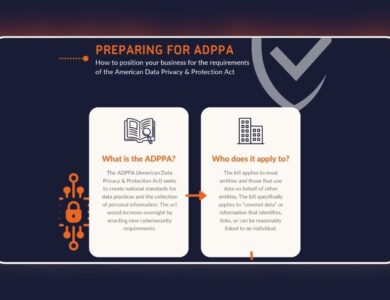

Infographic

Preparing for the ADPPA

Blog

How Businesses Can Prepare for the ADPPA

Infographic

Five Key Factors Influencing Consumer Payment Preferences

News

GoSee Enhances Contact Center Payment Experience with PCI Pal

Blog

What are the main differences and similarities between PCI DSS and HIPAA?

Blog

Consumer Benefits of Pay by Bank

News

PCI Pal Shares Top Predictions for Payment and Security Trends in 2023

News

Future of Payments survey finds increasing consumer trust toward digital payment methods

News

PCI Pal’s New Pay By Bank Innovation Shortlisted for 2023 Card & Payments Awards

News

PCI Pal extends G-Cloud certification

Blog

Security risk: Are you still using POS terminals in your contact center?

News

Air Europa chooses PCI Pal Agent Assist to enhance Contact Center payment processes

Success Story

Air Europa futureproofs payment security and CX with PCI Pal

Blog

Contact centers are shifting gears: Entering the era of digital payments

News

PCI Pal Named “Data Security Solution Provider of the Year” in 2022 CyberSecurity Breakthrough Awards Program

News

PCI Pal Partners with Virgin Atlantic to Secure its International Omnichannel Payments

News

Cybernews Payments Interview with PCI Pal’s CISO

News

PCI Pal Launches Open Banking Payments for Contact Centers: the first in a series of new payment products

Podcast

Keep Calm and Simplify

News

PCI Pal Extends Patent Portfolio in US and Australia for Processing Sensitive Information over VoIP

Success Story

National Express boosts customer service with 8×8 and PCI Pal

Podcast

Payments 22: The Future of Security and CX

Blog

Simplifying Contact Center Payment Security

News

Teleperformance UK selects PCI Pal to secure expanding payment methods for global enterprise customers

News

PCI Pal Named Winner in Coveted Categories at Annual CNP Awards and Global Infosec Awards

News

PCI Pal ranked in the top 100 Fastest growing companies in the UK

Video

Calabrio Presents: Improving Customer Experiences through Performance Management

News

Freshworks and PCI Pal partner to futureproof omnichannel payment security for Bensons for Beds

Success Story

Bensons for Beds futureproofs omnichannel payment security with PCI Pal and Freshworks

Podcast

PCI DSS v4.0: What it means for Compliance in the Cloud

Ebook

Starting Your PCI Compliance Journey

Infographic

Data Privacy in Australia

News

PCI Pal, Servadus, and Verizon Release Joint White Paper Addressing Contact Center Best Practices in the Wake of PCI DSS 4.0 Rollout

White Paper

Keep Calm and Simplify: Contact Center Best Practices in the Era of PCI DSS 4.0

Video

Talkdesk Presents: Delivering Better Payment CX

Ebook

This is Australia 2022: The State of Security through the Eyes of Australian Consumers Today

Video

Worldpay from FIS Presents: Digitizing B2B Payments

Infographic

Data Privacy Legislation and Payments in Canada

News

PCI Pal partners with Odigo to provide secure payments

Success Story

Greg Rowe Limited partners with Talkdesk and PCI Pal for secure payments

News

Greg Rowe’s contact center solution keeps customer communications and payments flowing with technology from Talkdesk and PCI Pal

Blog

PCI DSS v4.0 and Payment Security: What You Need to Know

News

PCI Pal partners with Five9 to provide secure payments on the Five9 CX Marketplace

Success Story

Public Sector – PCI Compliance for Australian Government Authority

News

Restaurant group Fridays UK chooses PCI Pal® to secure card payments

Success Story

Retail – PCI Compliant Payments for Restaurant Group Fridays

News

PCI Pal® unveiled as 21st best-performing tech scale-up in the UK at 2022 Megabuyte Emerging Stars awards

News

Survey Finds All Payment Channels Face a Distrust Deficit in the Wake of COVID-19

Ebook

This is Canada 2022: The State of Security through the Eyes of Canadian Consumers Today

News

PCI Pal® marks Australian launch with senior VP appointment

Success Story

Retail – Major British Multinational Retailer

News

PCI Pal® wins Best Compliance Product at the CX Awards 2022

News

PCI Pal® announces new global partnership with VoiceFoundry, a TTEC Digital Company.

Podcast

Love your customer

Success Story

Utilities – PCI Compliant Contact Center Payments for Natural Gas Supplier

News

The Call & Contact Center Expo Names PCI Pal Finalist for Security Solution of the Year

News

PCI Pal® shortlisted for the Best Compliance Product in the CX Awards 2022

Success Story

Retail – Secure Payments for Leading European Furniture Manufacturer

Success Story

BPO – Securing Payments for Leading US Business Process Outsourcer

News

International Survey Probes the Future of Customer Service and Considers Consumer Preferences versus Contact Center Strategies

Ebook

Security in the Contact Center: A Comparative Study of Consumers and Contact Center Professionals

News

PCI Pal Provides Secure, Compliant Payments for Talkdesk Global Customers

News

Delivery speed and transaction security top the list of festive shoppers’ worries for 2021, in PCI Pal®’s annual yuletide survey

Success Story

Secure phone payments for leading US cable provider

Podcast

Working smarter – are you PCI compliant?

News

PCI Pal® finalists in 2022 Card and Payments Awards

News

Chill Out, Relax, Take It Easy: PCI Pal® Removes the PCI Compliance Worry from Chill Insurance

Success Story

PCI Compliant Payments for Chill Insurance

News

Gearing up for 2022: PCI Pal® Releases Top-Level Insights to Prepare Businesses for a New Year of Cyber Crime

News

Michelin implements PCI Pal® for Secure and Compliant Payments

Success Story

Retail – PCI Compliance for a Global Appliance Manufacturer

News

PCI Pal® wins Payments Compliance Technology of the Year at the Payments Awards 2021

News

PCI Pal® wins Payment Solution award at the Credit & Collections Technology Awards

News

PCI Pal® wins three accolades at the WorkL Workplace of the Year Awards

Success Story

Retail – Secure Omnichannel Contact Center Payments

News

Puzzel extends partnership with PCI Pal®’s omnichannel payment portfolio

News

PCI Pal® to discuss The Future of Security & CX at Call and Contact Centre Expo 2021

News

Happiness matters: PCI Pal® shortlisted for WorkL Workplace of the Year Awards 2021, supported by The Telegraph

Video

What Is PCI Compliance?

News

PCI Pal® shortlisted for Enterprise Security Solution award at Security Excellence Awards 2021

News

PCI Pal Announces Amazon Connect Integration and AWS Marketplace Availability

News

Cybersecurity breach at Neiman Marcus will test consumers’ retail confidence ahead of the busy festive period, warns PCI Pal

Ebook

Securing Payments in an Omnichannel Contact Center

News

PCI Pal® and Puzzel secure telephone payments for GC Business Finance

Success Story

Financial – GC Business Finance

News

PCI Pal® signed-up to reduce payment security risk for Essex County Council

News

Fewer than 10% of People are Confident about their Data Security on Social Media, According to Survey from PCI Pal

News

PCI Pal® announced as a finalist in the 2021 Cloud Excellence Awards

Podcast

Securing Payments in 2021 Australia

Infographic

Descoping: An Investment Providing Savings & Returns

Ebook

A Security Assessor’s Guide

News

PCI Pal® Publishes Payments: The Future of Security and CX Whitepaper

White Paper

Payments: The Future of Security & CX

News

PCI Pal® and Their Partner 8×8 to Discuss Reimagining Service Delivery at the SOCITM President’s Week 2021

News

PCI Pal® Solutions Now Available as a Premium App on Genesys AppFoundry

News

InsureandGo Extends PCI Pal® Payment Security Solution to Australian Operations

Podcast

PCI DSS v4.0: The Challenges for Organizations and QSA’s

News

PCI Pal® Awarded Best Call Centre Solution at CNP 2021

News

Halfords Places Customer Service and Experience in Pole Position

Infographic

Which Self-Assessment Questionnaire (SAQ) Is Right for You?

Success Story

Retail – Halfords

News

AvalonBay Selects PCI Pal® to Securely Handle its Contact Center Payments

Success Story

Leisure – AvalonBay

Podcast

Post Pandemic Payments

News

PCI Pal® Appoints Mufti Monim as New CTO

Podcast

Payments: The Future of Compliance and CX

News

PCI Pal® Supports Royal Exchange Theatre With Its Payment Security Compliance

Video

Ciske van Oosten Presents Payments 2021 Closing Keynote: Engineering Effective & Sustainable Payment Security by Design

Video

Neira Jones Presents Payments 2021 Opening Keynote: Secure Payments, CX Friend or Foe?

News

PCI Pal® Releases Podcast Highlighting the Top 5 Agenda Items for CISOs in 2021

Podcast

Podcast: Five Agenda Items for CISOs in 2021

News

PCI Pal® Encourages Organizations to Consider Adopting a Company Culture of Security and Compliance on Data Protection Day 2021

News

PCI Pal® Announces Partners for Upcoming Payments: The Future of Security and CX Conference

Podcast

Podcast: Making Compliance a Habit

News

Online Shoppers More Concerned About Deliveries Than Personal Security, According to PCI Pal® Survey

Podcast

Podcast: Compliance in the Cloud

Podcast

Podcast: Compliance for the Public Sector

News

Predicting the Unpredictable: PCI Pal Releases Cybersecurity and Compliance Predictions for 2021

News

PCI Pal® Supports InsureandGo with Payment Security and Compliance

News

PCI Pal® Shortlisted for Best Technology Initiative at the Card and Payments Awards

Success Story

Financial – MAPFRE: InsureandGo

Success Story

Government – South Staffordshire District Council

Video

Agent Assist Solution

Video

IVR Solution

Infographic

PCI DSS Compliance Comes Under the Spotlight in Verizon’s 2020 Payment Security Report

Ebook

Partner Program Datasheet

Success Story

Retail – TRADER

News

PCI Pal® Receives G-Cloud 12 Certification

Webinar

What Now? Future-Proofing Your Payments

News

PCI Pal Announces Partnership with Calabrio and Joins the Calabrio Marketplace

News

PCI Pal® Recognized as Notable Tech Innovator Following Tech East 100 Award

Ebook

Solutions Brochure

Success Story

Logistics – Logistics Industry Success Story

News

PCI Pal® Adds Speech Recognition Capability to Its Cloud-Based Agent Assist and IVR Payment Solutions

News

PCI Pal® Announces the Formation of the PCI Pal Advisory Committee and Its First Member, Neira Jones.

News

PCI Pal® SVP Nominated in the Computing Women in Tech Excellence Awards

News

PCI Pal® Announced as Finalist in Insurance Times Tech & Innovation Awards

News

PCI Pal® and Civica Host Payments Security and Compliance Webinar for the Public Sector

News

Survey Finds Majority of Europeans Will Take Custom and Loyalty Elsewhere Following a Security Breach

News

Survey From PCI Pal® Reveals Australians’ Concerns Relating to Data and Payment Security Practices During the Coronavirus Pandemic

News

PCI Pal Partners With Avaya Contact Center to Deliver an Integrated Cloud-Based Compliance Solution for Telephone and Digital Payments

News

PCI Pal® Progresses Partnership with Leading Cloud Contact Center Provider Talkdesk

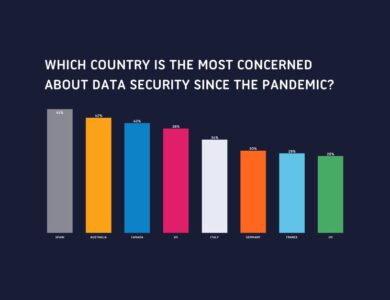

Infographic

Data Security in the Eyes of the Consumer Post COVID-19

News

Waltham Forest Council Implements PCI Pal to Secure Cardholder-Not-Present Payment Transactions

News

Survey From PCI Pal® Shows Significant Consequences for Businesses that Demonstrate Poor Data Security Practices During the Pandemic

Success Story

Government – Waltham Forest

News

Pennon Water Services Keeps Its Customer Experience Flowing Thanks to Vonage and PCI Pal®

Success Story

Utilities – Pennon Water Services

Success Story

Public Sector – Delivering Security and Compliance to the Public Sector

News

PCI Pal® Shortlisted for Omnichannel Solution of the Year

News

PCI Pal® Launches Webinar Series on Payment Security Compliance

News

PCI Pal® Launches New Capability to Rapidly Deliver Secure Payment Services to Businesses With Home and Remote Workers Within 48 Hours

Infographic

PCI Compliance: Then & Now

Infographic

PCI Compliance for Large Organizations: 10 Tips

News

PCI Pal Nominated for Best Compliance Provider Award at CNP 2020

Video

SixPackAbs Case Study

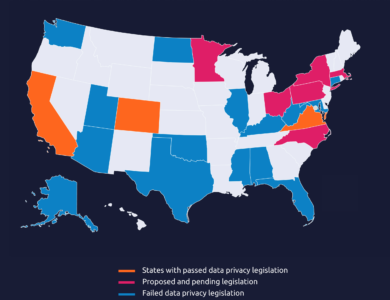

Infographic

Data Privacy in the US

News

PCI Pal® Launches PCI Pal Digital for Omnichannel Payment Security

News

PCI Pal® Wins PCI Excellence Award in Recognition of Customer Success

News

PCI Pal® Advances to a Cisco Preferred Solution Partner

News

Vax Transforms Telephone Payment Transaction Process With PCI Pal®

Success Story

Retail – VAX

Success Story

Government – Delivering Compliance to Local Authorities

Webinar

Compliance in the Cloud

News

PCI Pal® Selected for Membership in Avaya’s DevConnect Program

News

PCI Pal® Study Reveals That Londoners Are the Biggest Risk Takers With Their Personal Data Security Practices

Video

PCI Pal Digital

News

PCI Pal® Urges Businesses to Remove ‘Tick Box’ Mentality to Ensure Year-Round PCI DSS Compliance

News

PCI Pal® Receives Double-Shortlisting in the 2020 Card and Payment Awards

News

Woodland Trust Enhances Telephone Payment Security With PCI Pal

News

The Woodland Trust Enhances Telephone Payment Security Thanks to PCI Pal®

Success Story

Healthcare – British Medical Journal

Success Story

Financial – Verex

News

PCI Pal® Builds on UK Partnership With 8×8 to Offer Secure Payment Services for Contact Centers Globally

News

PCI Pal Named “Compliance Software Solution Provider of the Year” Award in 2019 CyberSecurity Breakthrough Award Program

News

PCI Pal® Announced as EMEA AppFoundry Partner of the Year at Genesys’ G-Summit Europe

News

PCI Pal® Shortlisted for Further Industry Awards

News

Inadequate Data Security Practices Come With Serious Financial Consequences for Canadian Businesses

Success Story

Utilities – Ecotricity

Ebook

This is Canada: The State of Security in the Eyes of Canadian Consumers 2019

Ebook

This is Australia: The State of Security in the Eyes of Australian Consumers 2019

Success Story

Retail – Six Pack Abs

News

PCI Pal® and Verizon White Paper Examines PCI Security Compliance in Contact Center Environments

White Paper

Keep Calm and Descope

Success Story

Outsourcing – DDC Outsourcing Solutions UK

Video

Agent Assist – Agent Demo

News

PCI Pal® Wins At CNP 2018 Awards

News

PCI Pal® Shortlisted for Comms Business Awards 2018

Success Story

Leisure – iFLY Indoor Skydiving

News

PCI Pal® Shortlisted for Retail Security Initiative of the Year at the Retail Systems Awards 2018

News

PCI Pal® Announced as Cisco Solution Partner for EMEA, USA & Canada

Video

Agent Assist – How it Works

News

PCI Pal® To Attend Call & Contact Expo 2018

News

8×8 and PCI Pal Partner on Compliance

News

PCI DSS 3.2 Set to Expose ‘Compliance Cramming’ Culture, Warns PCI Pal®

News

PCI Pal® Celebrates an Award Win at the PCI 2018 Awards for Excellence

News

PCI Pal® Shortlisted for the 2018 Card and Payments Awards

Success Story

Retail – AllSaints

Video

AllSaints Case Study

Success Story

Outsourcing – Serco

Success Story

Leisure – KidZania

Video

Serco Case Study

Video

Kidzania Case Study

Video