Ensuring every payment

is seamless and secure

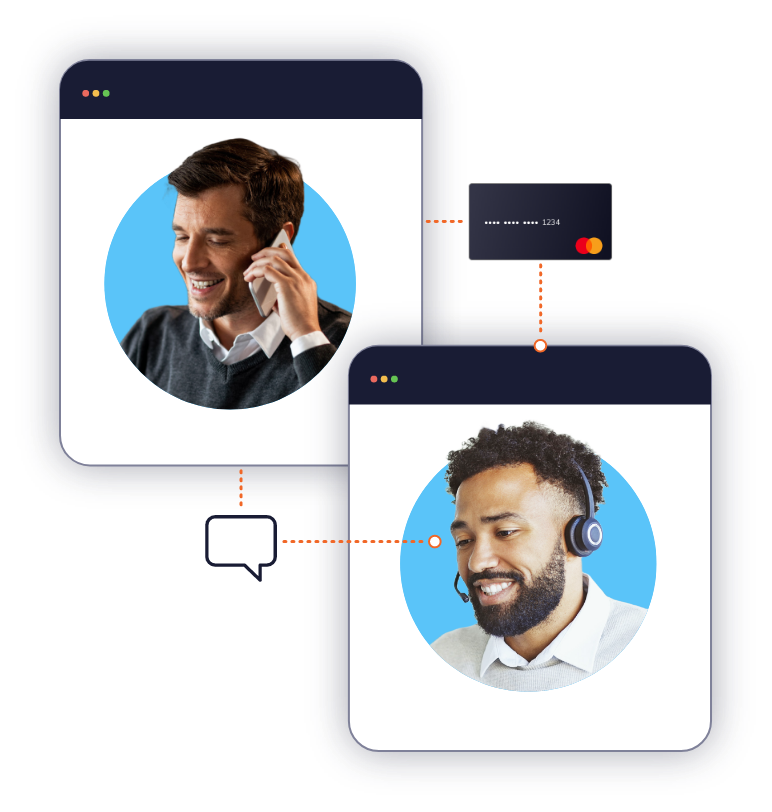

You need to take payments from customers within your contact center. You want to ensure this process is secure and compliant, however, you don’t want to add complexity, extend call durations, or put additional pressure on your agents. This is why you need to focus on:

Simplifying the

process

By leveraging a solution that is intuitive for both customers and your agents to streamline the payment process.

Natural part of

the interaction

By allowing your agents to continue to interact with and guide your customers through every step of the payment process.

Supports all

channels

With a single solution that can support payments over the channels you use now or could use in the future including phone, chat, SMS, email and IVR self-service.

Payment

choice

Allowing customers to use the payment method they prefer whether that be a card, an eWallet, pay by bank or buy now pay later options.

Easy to

deploy

By using a proven SaaS-based solution that is quick to deploy and instantly delivers value to your contact center.

Secure &

Compliant

By ensuring no payment details enter your systems or are visible by your agents instantly becoming PCI DSS compliant.

A simple, frictionless customer payment experience

You want to ensure you deliver the best possible experience to your customers and this includes removing the friction and frustration of the payment process.

We help you do this with a comprehensive secure payment solution that is designed for contact centers. Your customers can make a payment over the channel of their choice: phone, chat, SMS, email or IVR. They can use their preferred payment method, card, eWallet or pay by bank and your agents are able to seamlessly guide them through an intuitive process.

Securing every payment & ensuring PCI DSS compliance

It is vital that you build trust with your customers, that you protect their personal information and that your payment process is secure.

We enable you to quickly establish that trust by providing a solution that is fully PCI DSS compliant and that is secure by design. We take the pressure off your agents, IT, and your compliance team by ensuring that no sensitive payment information enters your systems or is visible to agents.

Enabling

future-fit agility

As a contact center you are constantly evolving how you engage with your customers to cater for changing preferences and with the aim of driving greater efficiency across your operation. As such, you need technology that is future-fit and creates agility.

PCI Pal provides you with that peace of mind; our SaaS-based solution is able to scale with you both in terms of capacity, but also the capabilities you utilize. As you extend your digital channels we can support you with digital payment options. If you want to introduce self-service, we offer an IVR option, and if you want to introduce new payment methods such as pay by bank or buy now pay later options, we provide this also.

We are proud to have

many happy customers:

PCI Pal’s tools are known as the Number One in the industry. It was exactly the solution we needed for the problem we had and they’ve delivered something absolutely spectacular.

A small step with a big impact

the value delivered by PCI Pal

More completed transactions

By having the agent support the customer through the process, resulting in far more payments being successfully completed.

Improved customer experience

By removing friction and simplifying the customer payment process, you improve the customer experience and drive greater retention.

Secure & compliant

By using a platform that is PCI DSS compliant and ensuring that no card payment details are captured or held in your systems.

Reduce handle time

By simplifying and streamlining the process, average handle-time is reduced, and you avoid the need for subsequent/repeat calls.

Improve agent experience

By taking the pressure off agents to collect and enter card details, you allow them to focus on delivering the best experience and make their role far more rewarding.

Reduce transaction cost

By enabling you to leverage those payment options that reduce per transaction costs and increase conversions.

Transform your payment experience today

Want to transform your customer payment experience and deliver an intuitive solution to your contact center and customer facing teams? Let’s discuss.