Frictionless payment

by digital link

Customers are increasingly interacting with you digitally and these channels are becoming a preferred option to make payments. Whether you are interacting with customers over the phone or over digital channels such as chat, SMS or email, you need to make it easy for customers to complete a payment. You need a true omnichannel payment solution that delivers key capabilities:

Supports digital channels

Enabling customers to pay when interacting with you over chat, SMS or email.

Easy for

customers

By simply providing them with a digital link and an interface that is intuitive to follow and to complete a payment.

Guided by

agents

The ability for your team to follow the process and guide the customer through every step of the payment process.

Provide payment

choice

Enabling the customer to use their preferred payment option including pay by card, eWallet, bank transfer or a buy-now-pay-later option.

Instills

trust

Through a process that is secure and ensures that no sensitive payment information is exposed to the contact center agent.

Simplifying

compliance

By ensuring that no payment details enter your systems, descoping the contact center from PCI DSS requirements.

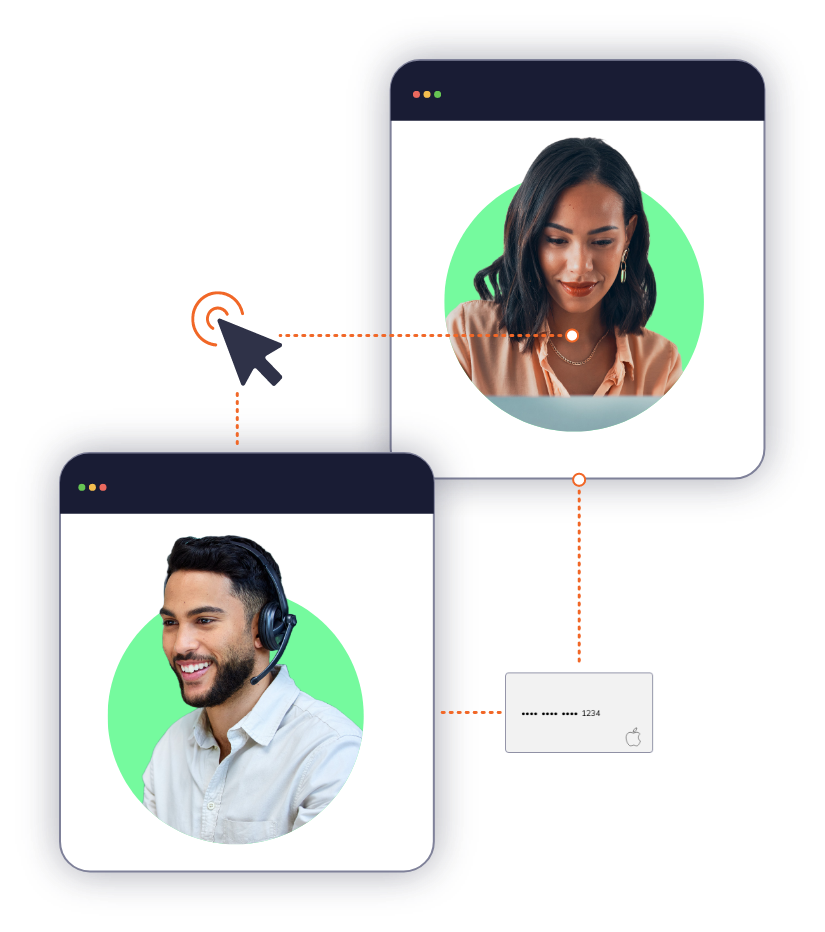

Enabling customers to click to pay

When customers are interacting with you over digital channels, or just prefer to pay digitally, you need to send them a secure digital link that enables them to follow simple steps to complete a payment.

We enable your customers to click to pay whether you are interacting over chat, SMS, email or the phone. At time of payment the agent simply generates and sends a digital link. By clicking on this link, customers are stepped through an intuitive payment process with options to pay by card, by eWallet, by bank, or to leverage any other options you may have like buy-now-pay-later. While sensitive payment details are kept hidden from the agent, they are able to see each step completed by the customer and can guide them through to successful completion.

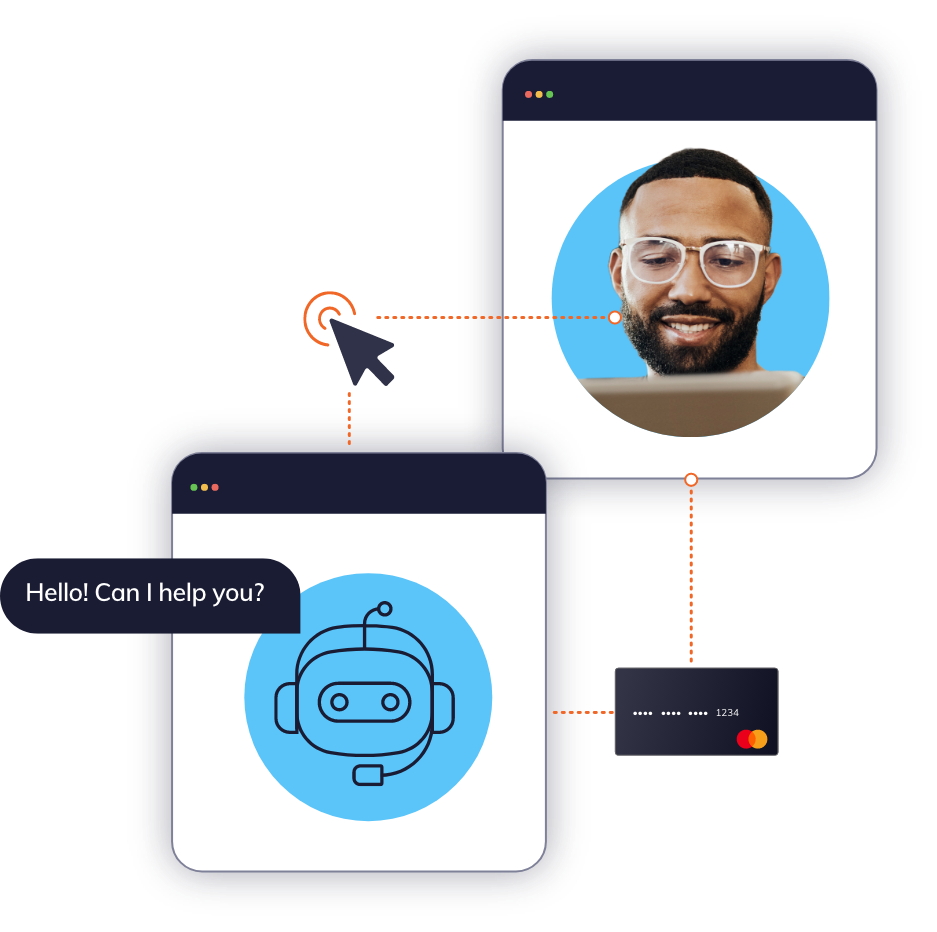

Enabling customers to pay by AI-bot

Generative AI and bots are transforming contact centers and driving efficiencies in the way we interact with customers. Enabling these bots to take secure payments can streamline the process and deliver faster and frictionless experiences.

PCI Pal’s secure digital payment solution has been integrated to leading AI-powered bot technology to fully automate the payment process. In a similar way as an agent guided process, the bot is able to generate a secure link and step the customer through to a successful, secure and PCI DSS compliant payment.

We are proud to have

many happy customers:

The PCI Pal team have always gone out of their way to adapt their solutions as our business needs have evolved. We would certainly recommend PCI Pal, not only are they digital, safe and secure, but they are also very forward-thinking, so great for any retail e-commerce business.

The PCI Pal

digital advantage

Improved customer experience

By enabling them to use the interaction channel they prefer and removing complexity and friction from the payment process.

Increased revenue

By offering more payment options to customers and guiding them through the process to ensure more successfully completed transactions.

Improve efficiency

By enabling more interactions with your customers, including payments, to be conducted and completed over more efficient digital channels including chat and AI-powered bots.

Secure & compliant

By ensuring that no payment details are captured or held in your systems but controlled by fully PCI DSS compliant solution that is secure by design.

Improved agent experience

By allowing them to focus on the interaction with the customer through simplifying the payment process and enabling them to deliver better outcomes on each and every engagement.

Reduce transaction cost

By not only making each payment more efficient but enabling you to leverage payment options that have a lower transactional cost.

Transform your digital payment experience today

Simply reach out to our team to find out more about how we enable digital payments in your contact center and across your customer-facing teams.