We don’t just reduce risk, we strengthen every part of your payment journey.

- Real-time fraud scoring:

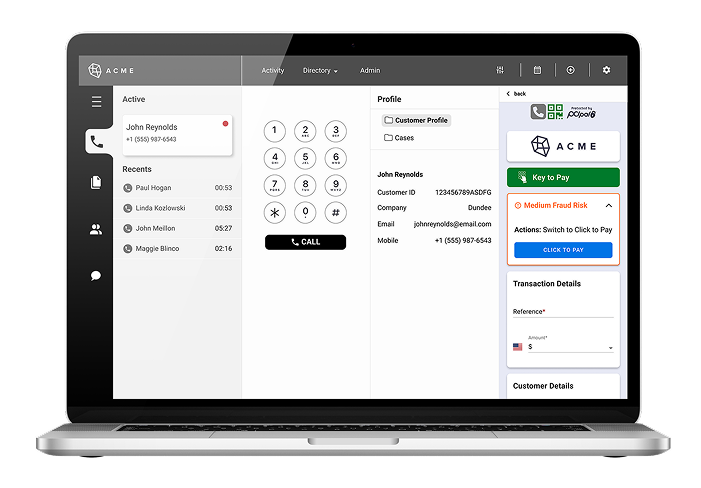

Identify high-risk calls before payments are processed using layered phone number intelligence. - Actionable insights for agents:

Empower agents with on-call fraud alerts and clear guidance — no delays, no second guessing. - Stronger chargeback protection:

Get the data you need to defend disputes and reduce chargeback costs with auditable fraud logs.

How it works

How it works

Secure, frictionless payments for hundreds of clients

We’ve fundamentally changed the way we’re handling our customer interactions. We have a new way of taking calls which is integrated with our Salesforce system and connects payments, billed interactions and customer contact in one place. It’s much more user- friendly and suits the way our customers want to provide the information to us - it’s a far better experience for our customers.

John Woodward, Head of Service Support, Ecotricity

Our latest solution gives contact center agents the power to stop fraud in real time. Explore it to learn:

Why traditional fraud tools are falling short in phone channels

How real-time scoring and phone intelligence flag threats before they escalate

What to expect from proactive, AI-powered approach to payment security

Get in touch with us

Want to see how proactive fraud detection fits into your contact center? Fill out the form to connect with our team of experts.

Explore other solutions on the PCI Pal platform

From compliance to customer trust, our tailored solutions help you meet key objectives without compromising on performance.